Unlocking the full potential of renewable energy investment in partnership with development finance institutions

In this article, we explore the potential of development finance institutions (DFIs) to support the growth of renewable energy and drive investment in the sector. Using Atlas Renewable Energy as a case study, we examine how innovative funding structures and strategic collaborations with DFIs make renewable energy projects more profitable and bankable while enabling the energy transition to become a reality.

Renewable energy remains a good investment in 2023 and beyond …

As the world continues to prioritize the transition to a low-carbon economy, renewable energy is poised to play an increasingly important role in meeting global energy demand, making it a sector to watch for investors seeking to make a positive impact while generating returns.

Renewable energy has been one of the most exciting and rapidly expanding sectors in recent years. In 2023, it remains a good investment due to several factors.

Firstly, renewable energy technologies, such as solar and wind, have become increasingly competitive with fossil fuels in terms of cost. This has been driven by improvements in technology and economies of scale, making renewable energy a more cost-effective option for individuals and organizations. This shift towards renewable energy has been further supported by ambitious renewable energy targets set by countries worldwide, which are expected to continue to drive demand for renewable energy in the coming years.

In addition to the declining cost of renewable energy, these projects can provide stable, long-term returns to investors.

Finally, investing in renewable energy is often seen as an impactful way to support the transition to a low-carbon future and address global environmental challenges, which can be a key consideration for investors who prioritize environmental, social, and governance (ESG) factors.

… but to reach scale, more investment is needed.

In spite of the tough macroeconomic environment of recent years, investors continue to flock into the sector. In 2022, funding for renewable energy rose to a record of US$495 billion, according to BloombergNEF figures, driven largely by solar investment, which jumped 36% year-on-year. At Atlas, we saw this growth firsthand as we interconnected numerous new projects across our Americas footprint.

While this upswing in investment is exciting if the world is to meet the Paris Agreement goal of limiting global warming to well below 2 °C, much more is needed – about US$131 trillion more, according to the International Renewable Energy Agency (IRENA), which calculates that the share of renewable energy in the global energy mix needs to double to 36% by 2050.

Since Atlas Renewable Energy was founded in 2016, its experienced team has worked hard to contribute to the sustainable, inclusive energy system of the future by developing financing mechanisms to help bring more investors into the sector. As well as executing numerous power purchase agreements (PPAs), which can offer a hedge against a corporate buyer’s fluctuations in power cost while providing a steady stream of revenue for investors over extended periods, we have also created innovative structures to mitigate risk, offer additional return potential, and create more investment opportunities.

Leveraging the power of Development Finance Institutions (DFI)

One of the most impactful ways to foster renewable energy transformation is by harnessing the support of DFIs to help scale up renewable energy investment from the private sector.

DFIs are established and guided by governments worldwide to pursue public policy objectives such as renewable energy transformations. With their ability to reduce financing costs, mitigate risks, and increase project viability, DFIs can enable renewable energy projects to become more profitable and bankable, thereby creating the favorable market conditions needed for more private capital to participate in their development.

DFI support can range from equity investments, by which an institution provides developers with the necessary funding to build and operate renewable energy projects, to guarantees, which help insurance investors in renewable energy projects against risk. They can also leverage their investment-grade rating – often higher than that of the sovereign in which they are operating – to tap low-cost funds for renewable energy projects via the issuance of green bonds. Furthermore, through blended finance, DFIs can provide a combination of grants, concessional loans, and market-rate loans to reduce the risk and cost of financing renewable energy projects, making them more profitable and bankable, especially in developing countries.

Reaping the benefits of investing in a DFI-supported project

As well as opening new opportunities for investors to secure more favorable returns, DFI support provides a range of other benefits.

DFIs can provide technical assistance to renewable energy developers, which can help to improve project design and increase the efficiency of renewable energy systems. This can result in cost savings and increased profitability over the life of the project. What’s more, DFIs can provide access to networks of experts, policymakers, and other stakeholders in the renewable energy industry, which can help investors to stay up-to-date on industry trends and opportunities.

Beyond this, the fact that DFIs conduct wide-ranging due diligence processes to manage and measure the impacts of their investments means that they will only partner with reputable renewable energy developers – giving investors and commercial lenders greater comfort in the project.

As part of its mission to accelerate the transition to a cleaner, more sustainable energy future, Atlas Renewable Energy has partnered with several DFIs on a number of its projects, paving the way for more investors to participate in the global energy transition.

Putting it into practice: how Atlas works with DFIs

Mobilizing investment by derisking and improving bankability

To finance the El Naranjal and Del Litoral solar plants in Uruguay, Atlas Renewable Energy partnered with IDB Invest, part of the Inter-American Development Bank. In this award-winning deal, IDB Invest provided a financing package consisting of senior and subordinated facilities structured as B-bonds. This facilitated the mobilization of capital from institutional investors, including Allianz Global Investors, John Hancock, Industrial Alliance, and BlackRock, and marked the first time institutional investors took subordinated risks in the renewable sector in Uruguay.

As well as IDB Invest’s participation, Atlas implemented several risk mitigation approaches to ensure this transaction was appealing to institutional investors. These included bankable 30-year term PPAs with a stable state-owned electric utility and beneficial terms including fixed price, inflation-adjusted payments over the PPA life, no requirement for minimum power generation, and curtailment provisions to compensate renewable producers.

Tapping into technical support through blended finance

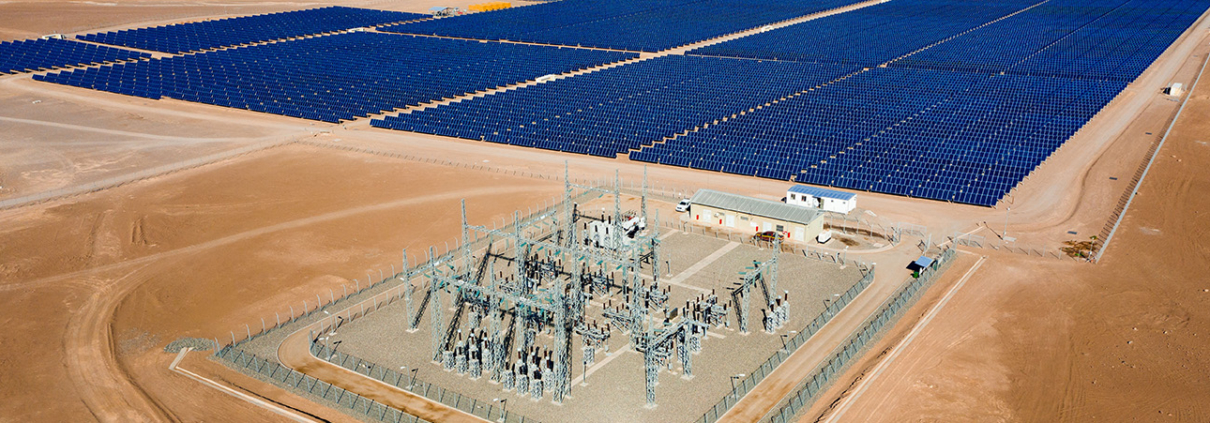

Atlas Renewable Energy also partnered with IDB Invest to support the design, construction, commissioning, and operation of two bifacial photovoltaic plants, with a combined capacity of 597 MW, in the state of Minas Gerais in Brazil.

This funding structure involved IDB Invest lending US$80mn of its funds, as well as mobilizing US$60mn of resources from DNB Bank, in addition to two blended financing loans of US$5mn each from the Climate Fund Canada for the Private Sector of the Americas – Phase II (C2FII) and the Clean Technology Fund (CTF), both managed by IDB Invest.

Beyond the financing aspect, the IDB Invest transaction also includes technical advice and financial incentives to accelerate gender inclusion and provide increased opportunities for underrepresented ethnic groups, targeting female technical workforce participation in the construction process of 15%, of which at least 30% are of African descent.

Overcoming currency volatility through US dollar-denominated financing

This year, Atlas Renewable Energy partnered with Brazilian DFI, Banco Nacional de Desenvolvimento Econômico e Social (BNDES) to finance its Boa Sorte solar project, securing a loan of US$210mn.

It marked the first time BNDES has executed a US dollar-indexed loan to a renewable energy project, setting a new precedent for project financing in Brazil. This dollar-indexed financing was a crucial prerequisite for making the project viable.

This was made possible due to a new regulation under Law #14,286/2021 – known as the Foreign Exchange Law, as of 31 December 2022 – which allows exporters to sign power purchase agreements (PPAs) in US dollars with authorized companies.

The funding that Atlas obtained under the new framework enables exporters in energy-intensive industries that sell their products in dollars to reduce their exposure to exchange rate fluctuations by allowing them to purchase electricity at prices linked to the dollar.

Atlas Renewable Energy: innovating for growth

As part of its mission to accelerate the transition to a cleaner, more sustainable future, Atlas Renewable Energy continues to collaborate with DFIs to bring more private capital into the renewable energy sector, making it more profitable and bankable. Atlas Renewable Energy’s successful partnerships with DFIs on a range of projects have set a blueprint for the renewable energy sector, demonstrating the potential for private and public entities to work together to drive the energy transition while generating returns. By prioritizing collaboration and innovation, Atlas Renewable Energy is well-positioned to make renewable energy investments more accessible, attractive, and impactful for investors seeking to contribute to a sustainable future.

In partnership with Castleberry Media, we are committed to taking care of our planet, therefore, this content is responsible with the environment.

Share This Entry