Power Purchase Agreements (PPAs): A Source of Stability in a Climate of Change

Whenever money is involved—especially with contracts—things can get complex. Then add volatile conditions, such as the recent pandemic, war, the climate crisis, and inflation, and things get even more complicated. These conditions have serious side effects, one of them being currency volatility. According to a 2021 article by DailyFX, currency volatility is “characterized by frequent and rapid changes to exchange rates in the forex market.” Basically, it means that currency value is unpredictable and virtually impossible to control.

Electricity prices can fluctuate as well. This compounded unpredictability is often the motivator for companies and owners of renewable energy projects to secure a power purchase agreement or PPA. Yet, there are signs that the current market volatility may impact these agreements over the long term. For example, a recent Pexapark report highlighted in Reuters states that the recent energy price volatility will have a lasting impact on the clean energy PPA market, which includes fewer long-term contracts.

But despite the recent volatility, PPAs can still provide a source of stability. According to an article by Martijn Duvoort of DNV, “PPAs have been a valuable tool in financing the energy transition to date, particularly in the USA, Latin America, and recently, the Nordic countries. With governments in many regions looking to phase out subsidies and feed-in tariffs, new renewable energy projects will be far more exposed to the fluctuations of the open markets. PPAs help to mitigate against the risks associated with such fluctuations, and will become an even more important tool for encouraging investment in new projects.”

So, where do we go from here? Let’s start at the beginning.

Power Purchase Agreements: The Basics

A PPA is a contract between a consumer and an energy-generating unit or portfolio thereof. There are two major categories of PPAs: physical delivery PPAs and virtual PPAs (sometimes called financial PPAs). The usual contract duration is between 10 and 20 years. The PPA negotiation is complex; it requires legal and occasionally technical advisors, and the typical time it takes to negotiate is 3‒9 months.

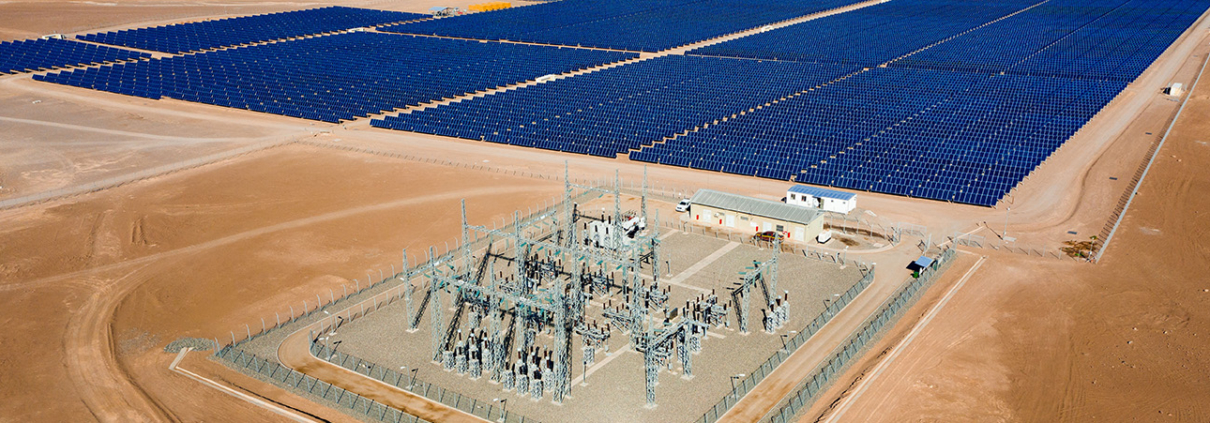

Given that power networks link generation units with demand, a PPA is not limited to on-site generation assets; most of the time, power generation is located offsite, sometimes not even within the same region. The PPA process can begin with a brand-new energy project that is ready to be built (including the location, size, and connection to the grid that is already agreed upon) or an existing project that has available generation capacity not committed in prior PPAs. For corporate PPAs, companies like Atlas Renewable Energy can help, especially as the need for international expertise grows.

Key PPA Benefits

As a mechanism enabling positive change, the PPA, at its core, aims to provide price certainty on electric power—fixing competitive energy costs for the client and providing cash flow stability to the generation asset, which is central to securing financing—which is why guarantees are so crucial in these agreements. However, PPAs can also be used to further a corporation’s sustainability goals, committing to buy only renewable energy from renewable energy projects that will be purpose-built and operated (a concept called “additionality”). As a result, companies can reduce their carbon footprint and partner with renewable generation companies with strong and recognized environmental, social, and governance credentials, thereby benefiting the environment, communities, and other stakeholders related to the renewable energy project.

Further, to help offset the ongoing changes, currency volatility, and price fluctuations mentioned earlier, a PPA has the ability to hedge against future price increases by allowing business owners to lock in a fixed price-per-unit of electricity over the duration of the contract.

Simplifying the PPA Process

Once a company decides it is ready to engage in a PPA, the following steps can help make the process smoother:

- Begin sooner rather than later. Even with existing volatile prices, PPAs can take several months to negotiate. And typically, the project that will commit to delivering the energy is going to be purpose-built, which can add another 1–2 years until completion. Therefore, it is better to begin now, in case even more changes arise that will affect the overall pricing.

- Conduct research on the existing market in Latin America, state policies for PPAs in the United States, and available providers (specifically on their reputation and track record—get references!).

- Hire an experienced advisor with an established track record to guide the process as well as qualified legal counsel and technical and financial consultants for the negotiation phase.

- Be prepared to ask critical questions about the PPA related to pricing, indexation, buyer and seller guarantees, duration, start date, commercial operation date, and risks.

- Involve the stakeholders who will be a part of, or potentially affected by, the PPA.

- Obtain approval, as needed, from senior management, a parliament or legislative body, a regulatory body, or another host government entity.

- Once approved and signed, continue to monitor the market as it evolves, as well as the asset’s value. Specifically, it is essential to create a strategy for this process, as well as perform a mark-to-market valuation as prices evolve.

PPA Risks

With any contract, there is a certain amount of risk. Even with PPAs, which have been around since the 1980s, there are risks that engaging parties need to plan for and be aware of. Noah Lerner of the Clean Energy Finance Forum discusses some of those risks as well as basis, shape, and operational risks in his 2020 article, “Navig ating Risk: A Corporate PPA Guide.”

An additional, sizable risk for structuring PPAs is the actual currency on the contract is built. An article by Greentech Media states that there are several currency risks that those engaging in a PPA need to be aware of, including local currency devaluation, availability of financing, and convertibility (i.e., converting from the local currency to U.S. dollars or another strong currency).

Converting to a currency that reflects the company’s cash flow is one way to help mitigate these risks. One example of using more competitive, international dollar-denominated financing was Atlas Renewable Energy’s recent 15-year PPA with Dow for Jacaranda, with its multimegawatt solar project in Brazil with a client that exports its production and thus receives dollar-denominated cash flows. The contract was secured with U.S. dollar financing (67 million dollars, to be exact). As a result, the project can meet its goals of achieving round-the-clock clean energy (thanks to an additional commercial feature allowing the customer to receive electric power 24 hours a day) for its business operations, as well as benefiting from greater price certainty.

During Volatile Times, PPAs Must Evolve

Volatility exists in the world now more than ever, and it can have long-ranging effects. Electricity prices seem to change on a daily basis. And for regions like Latin America, fluctuating currency value is making it challenging to fund renewable energy projects at the contractual level. Right now, it can feel like risks abound. But even in highly uncertain times, there are solutions.

What’s essential is that PPAs provide value. These agreements are at the forefront of getting renewable energy deployed worldwide. However, to do so, they must be structured in the right way so that all parties gain the price certainty and best financial outcome they need over the long term.

But, like anything, PPAs must evolve—as conditions and currencies change, technologies emerge, and new purchasing or contracting options arise. As the renewable energy industry continues to grow, its related pricing can vary, becoming more complex. As a result, PPAs must strategically adapt to these ever-changing conditions to not only continue serving business owners and investors but help the world transition to a clean-energy (and financially feasible) future.

In partnership with Castleberry Media, we are committed to taking care of our planet, therefore, this content is responsible with the environment.

Share This Entry