Is a Dollar-Based PPA Ideal for Achieving Your Company’s Sustainability Objectives?

Power Purchase Agreements (PPAs) offer a spectrum of advantages for long-term energy procurement, key among them being cost predictability, supply security, and enhanced access to financing.

These agreements, particularly crucial for companies targeting net-zero emissions, enable the procurement of electricity from renewable sources, thereby playing a vital role in the decarbonization of operations.

An emerging trend in Brazil, influenced by recent regulatory changes, is the adoption of USD-indexed PPA models. These dollar-denominated contracts are becoming increasingly popular, offering a more advantageous scenario for energy contracting within the Brazilian market.

Ricardo Mendes, Director of Origination at Atlas Renewable Energy in Brazil, underscores the relevance of long-term power purchase agreements (PPAs) for businesses. These contracts offer a robust shield against the volatile energy market, significantly impacted by Brazil’s rainfall patterns. Given the country’s reliance on hydroelectric power, which is highly dependent on precipitation levels, these agreements provide much-needed stability and risk mitigation for companies navigating the energy sector.

“To distance themselves from this volatility and not be exposed to high prices, companies seek protection through long-term contracts, such as PPAs. This ensures predictability in the company’s cost,” said Mendes.

Additionally, the possibility of establishing these agreements in US dollars has attracted exporters and companies in industries whose costs are linked to commodities.

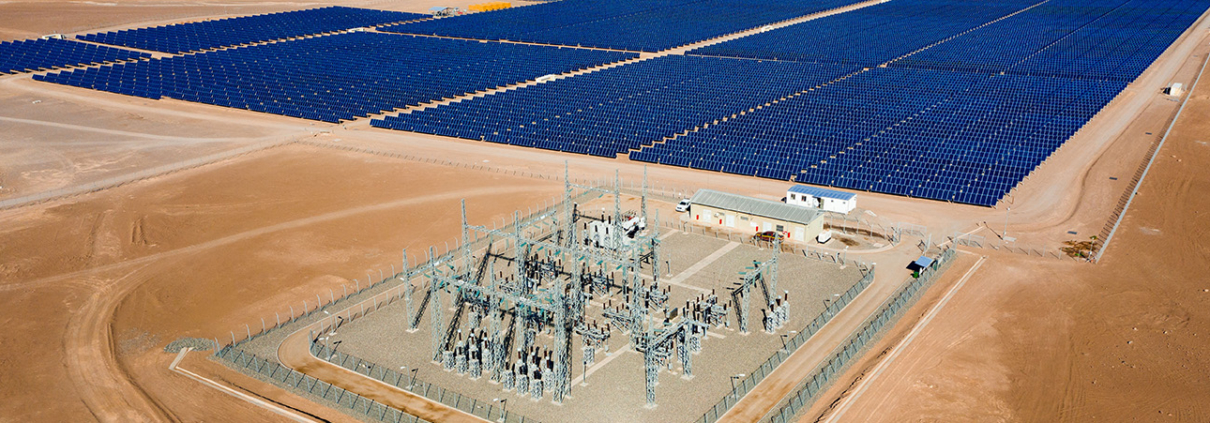

In 2022, for example, Atlas formed a joint venture with Hydro Rein and Albras (Brazil’s largest primary aluminum producer) to develop, build, and operate the Boa Sorte solar plant (438 MWp) in the state of Minas Gerais.

In this self-production model, the dollar-denominated PPA signed with Albras foresees an 814 GWh yearly supply from 2025 to 2044, covering 12% of the aluminum producer’s annual energy consumption.

“It’s a triple hedge. In addition to protecting from climate-related volatility, a variable in the energy market, companies are protecting themselves from exchange rate volatility and Brazil’s inflation. They find themselves more comfortable because if the dollar falls and their income decreases, their energy cost also reduces,” emphasizes Mendes.

Trust is, of course, a crucial element of PPAs, given the nature of the contracts and their lengths. “Long-term PPAs are a relationship of trust. When we talk about self-production, which in today’s market is the one with the greatest interest, the importance of a relationship built on trust, reliability, and knowledge is even greater,” he said.

What you need to know about dollar-denominated PPAs:

Flexible Contracts

At Atlas, we specialize in tailoring Power Purchase Agreements (PPAs) to match the unique profiles of each client. One strategy that has proven highly effective in the Brazilian market is the self-production model. This approach offers businesses the opportunity to hold an equity stake in our solar parks, which can lead to substantial energy cost savings. In some instances, clients have been able to achieve nearly 50% reduction in electricity costs.

The structure of each project is a collaborative effort, defined through mutual agreement. Our role encompasses the development, construction, financing and operation of the solar parks, typically in US dollars. The pricing within the contract is a matter of negotiation between us and our clients, along with the terms of price adjustment. This flexibility in structuring and financing reflects our commitment to providing solutions that are both economically advantageous and aligned with our clients’ specific energy requirements.

“There are contracts with prices adjusted for U.S. inflation; contracts where a curve is established, starting with a higher value and decreasing over time. In other words, the model allows for a series of alternatives that can be agreed upon between Atlas and the client,” Mendes explained.

In our approach to energy procurement, clients are offered the choice to select their energy requirements on a monthly or yearly basis, aligning with their specific consumption needs. This system is designed to accommodate fluctuations in energy use, ensuring that clients only procure what is necessary for their operations.

In cases where energy consumption is less than the amount purchased, the surplus energy – for instance, if 100 MW is purchased and only 99 MW is used – the additional 1 MW can be resold in the market or returned to us at Atlas. The Brazilian energy market’s flexibility often allows for the resale of this surplus at a potentially higher rate than the original purchase price. We offer various options for handling such scenarios, providing our clients with the opportunity to optimize their energy strategy in a way that suits their unique operational requirements.

Supply Security

One prevalent concern about renewable energy is its intermittent nature. A frequently asked question is: What happens during periods without sunlight? Will the power supply be consistent?

Ricardo Mendes addresses this concern, affirming that a continuous power supply is maintained. At Atlas we achieve this through diversified commercial agreements with various renewable energy producers, including wind energy providers, to ensure a steady flow of energy.

This strategy includes an energy exchange mechanism that manages surplus production effectively. For instance, solar energy, which is produced during daylight hours, is carefully balanced against consumption patterns. Any excess generated during the day can be exchanged in the market, facilitating an energy balance. At Atlas we actively engage in this energy market, swapping surplus daytime energy with those who have excess power at night, ensuring a consistent supply. This exchange occurs without incurring additional costs to the customers, thus guaranteeing a reliable energy supply throughout.

Cost Reduction and Efficiency Gains

Self-production in renewable energy, particularly with solar, presents a notable efficiency advantage. However, it’s not always feasible for a factory to meet its entire energy consumption through on-site solar installations due to space constraints. Moreover, factors such as irradiation levels and technology of the equipment significantly influence the energy output.

As Ricardo Mendes notes, while some companies may have ample roof space, the installation of the most efficient generation systems, like solar trackers that follow the sun’s movement, is often not possible. Typically, solar panels are fixed on roofs, which can result in lower performance.

By entering into a long-term Power Purchase Agreement (PPA), a company can access energy from a solar park that’s optimally located for better irradiation and equipped with state-of-the-art technology. This arrangement ensures the highest possible efficiency in electricity generation. Such PPAs allow businesses to benefit from advanced solar installations that might not be feasible at their own sites, thereby enhancing overall energy efficiency.

“You manage to avoid work, avoid construction within your operation, and you can have that energy with the highest efficiency and the lowest possible cost by using those parks that will have a larger scale and be optimally irradiated,” he adds.

Dollar Pricing

Several key factors contribute to the formation of dollar pricing in Power Purchase Agreements. These include the cost of constructing the plant, the consumer’s competitiveness relative to the local market and other consumers, and each company’s specific strategy for financing the energy.

Ricardo Mendes emphasizes the importance of long-term competitiveness in this context. He notes, for example, that a Brazilian aluminum producer must maintain operational costs within an energy price range that is competitive with counterparts in countries like Australia or Canada.

Another critical reference point is the price in Brazil, denominated in reais. Initially, a base price is established. From there, the pricing can either be fixed, to mitigate the risk of inflation, or adjusted according to U.S. inflation rates, given that the contract is in dollars. These adjustments typically occur on an annual basis. This pricing structure aims to balance local market conditions with the stability offered by a dollar-denominated agreement, ensuring competitiveness and financial predictability.

Financing Attraction

The new legal framework in Brazil (Law 14.286/2021) inaugurated a time for the financing of projects, as it brought greater legal security to dollar-denominated PPAs.

Mendes says the framework gave more security to the consumer company, the generator that will make its investment and the banks. “Atlas pioneered this model in Brazil and even signed the first USD PPA financed by BNDES, said Mendes.

The credit of USD 210 million (equivalent to about R$1.1 billion) was granted by the National Bank for Economic and Social Development (BNDES) in January 2023 to finance the Boa Sorte solar complex (438 MWp) in Minas Gerais, and most recently Atlas received the largest ever USD loan USD 447.8 million or R$2,18 billion) for renewable energy from BNDES in Latin America to construct Vista Alegre (902 MWp).

This type of experience exemplifies how the company has been weaving agreements to offer clients the best business options, including the possibility of attracting international financing. “Having already established relationships with international banks, which is another important source of resources, helps to expand the range for clients,” concludes Mendes.

In partnership with Castleberry Media, we are committed to taking care of our planet, therefore, this content is responsible with the environment.

Share This Entry