How financial innovation can drive the growth of renewables in Latam

Like technology, renewables continuously benefit from systemic advances. Even so, not all breakthroughs arrive in the form of more efficient solar panels. Some come from breaking ground in financial innovation.

The financing of projects in the renewables sector performs the essential role of enabling the industry to progress. In other words, without viable financing providing funding for projects, the industry comes to a halt. New and improved methods of funding create novel opportunities for investors and, with better financial structuring come lower energy prices for consumers. Further, backing large-scale renewables projects in this way that reduces the cost of energy prices, enables further deployment of clean energy and economic growth in the region.

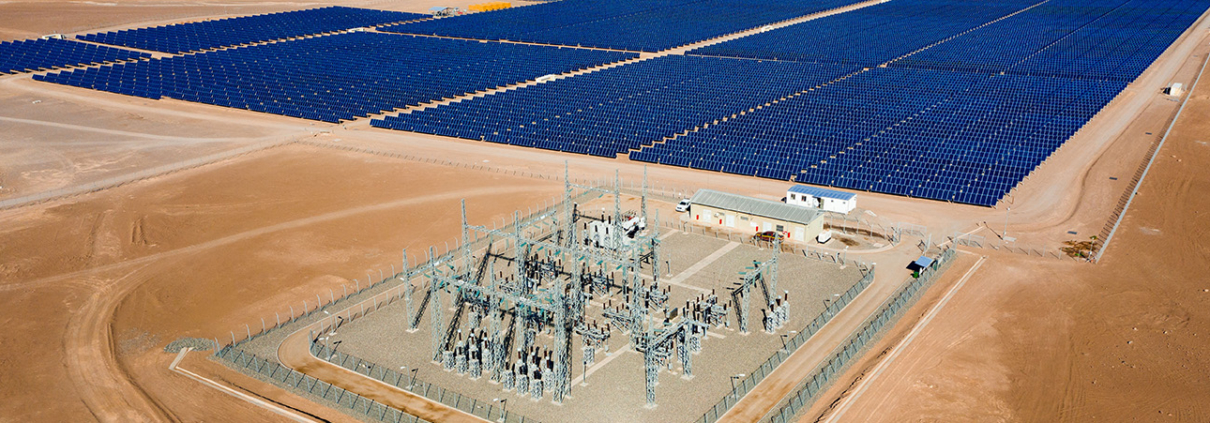

Atlas Renewable Energy Breaks Ground

Atlas Renewable Energy’s expansion is focused on Latin America’s emerging market economies. With ongoing technological and financial innovations, we have been able to offer clean energy in the region leveraging a deep track record in development, financing and execution. We believe tailored financial structuring can enable more accurate risk allocations resulting in lower prices to end consumers. This can be advancement that can be as consequential as solar technology enhancements.

Throughout the region we have developed several solar plants with different financing structures. One such project is located in Uruguay, where our client for the energy produced is a state-owned company, UTE, that required a power purchase agreement (PPA) that lasted over 25 years. This posed an interesting challenge and opportunity because most banks that can fund these types of projects can only provide funding for 10 to 15 years, and a very additional few can provide up to some 18 years. We solved this by pioneering a new financing structure where two long-term private placements (i.e. bonds) were issued in the United States that allowed multiple investors around the world to participate in differing risk allocations – these bond investors are accustomed to longer tenor horizons.

The deal was specifically composed of an investment-grade senior bond totaling $103 million and the remainder came via a subordinated debt bond totaling $11.5 million, of which IDB-Invest funded a proportional share. (DNB Markets Inc. acted as co-arranger and placement agent of the senior and sub B tranches.)

The senior and subordinated bonds have a duration of 24 years and 15 years, respectively, after which the investors exit their investments and Atlas Renewable Energy continues to operate and supply the energy requirements for the remainder of the PPA. The deal was backed by IDB-Invest as the lender of record (of the Inter-American Development Bank Group, an affiliate of the World Bank) and was arranged as an A/B Bond structure that included both senior and subordinated note tranches. This collaboration was a completely novel arrangement in the context of Renewable projects in Latin America and allowed Atlas Renewable Energy to be presented with the Structured Bond Deal of the Year by Bonds & Loans Latin America Awards.

What was particularly interesting about the deal is that it shows that international investors can and want to participate in the region’s energy development, that long-term tenors at very good rates can be secured and that this new financing structure can serve as a new model to help solve the long-term capital needs of the region. This is also testament to the proven-nature and stability of Renewable technologies; which investors are recognizing as low-risk and reliable over a truly long-term horizon.

Benefits of the B-Bond

Financing with the structure of B bonds allows for the expansion of substitute funding sources through capital markets for private investors under a multi-lateral umbrella, providing a strong and suitable alternative to bank funding or traditional capital markets funding. This type of financing aids in bringing additional liquidity and potential value to a given transaction, under the implicit political risk insurance structure from the IDB through its role as ‘lender of record’.

Capital Markets Innovation for Solar PV

The parameters required to achieve an investment-grade rating for a solar PV green bond remain quite onerous and conservative in nature. From a cash flows perspective, an investment-grade bond will require a relatively low percentage of the plant’s revenues to repay the associated debt (as compared to long-term bank loans, for example). Given the track-record of the PV technology as an asset class, there is ample investor appetite for risk exposure to additional cash flows at a competitive rate-of-return (up to 80% in the case of long-term bank loans); especially when there is a limited merchant component. For this reason, the incorporation of a subordinated or “mezzanine” tranche provides an interesting solution to achieve more robust leverage ratios, ultimately resulting in lower power prices for end consumers. Financial innovation can play a key role in the growth of renewables in Latam. When done right it can offer new possibilities for investors, attractive rates of return and energy savings for consumers. These strong wins for all parties involved, underscore the potential and bright future renewables have in Latin America and is one of the reasons for optimism in this industry.

Share This Entry