By the Numbers: Why Companies Are Choosing Renewable Energy Contracts

The convergence of wind, solar photovoltaic technologies, and advanced energy storage solutions have reached unprecedented cost-effectiveness over the last decade. This evolution enables corporations to secure Power Purchase Agreements (PPAs) that deliver long-term price predictability and strategic supply stability.

Renewable energy sources, particularly onshore wind, and solar photovoltaic technologies, have emerged as transformative forces in the global energy paradigm since the millennium’s inception. The International Renewable Energy Agency (IRENA) reports a 3.7-fold expansion in clean energy generation capacity between 2000 and 2020, scaling from 754 GW to 2,799 GW.

While environmental demands have catalyzed this transformation, driven by both the 2015 Paris Agreement’s multilateral commitment to CO2 reduction among 200 nations and intensifying consumer demands for corporate carbon footprint mitigation, the fundamental driver of renewable energy’s unprecedented growth lies in its compelling economics. The sector has evolved into a sophisticated, technologically mature market that presents persuasive value propositions for corporate entities.

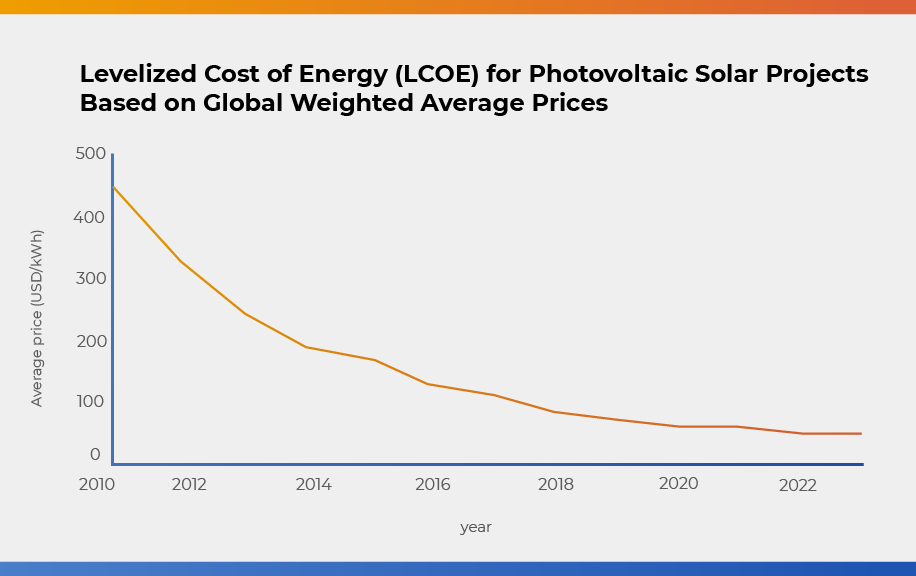

IRENA’s analysis of global market dynamics reveals a dramatic shift in cost structures: solar photovoltaic generation costs have decreased from USD 445 per MWh in 2010 (excluding regional subsidy frameworks) to USD 59 per MWh in 2020, further optimizing to USD 44 per MWh in 2023.

Source: IRENA – Renewable Power Generation Costs in 2023 Report – Source: IRENA

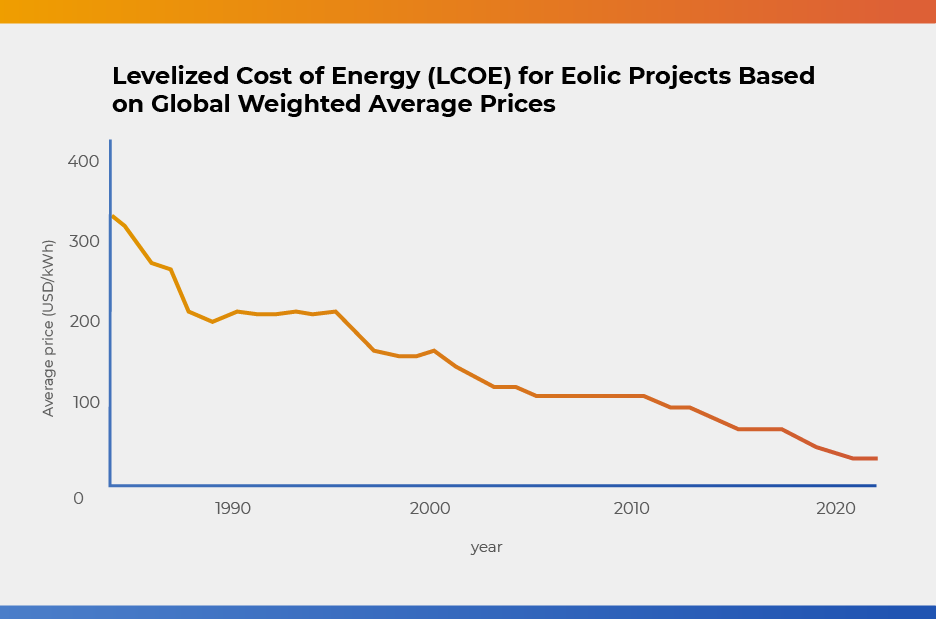

Despite being a much more mature technology, wind energy also experienced a significant price drop: from USD 107 per MWh in 2010 to USD 39 per MWh in 2020 and USD 33 per MWh in 2023. In 1984, the price was USD 339 per MWh, highlighting a remarkable decline over time. In other words, the cost of generating one MWh of electricity with wind energy decreased by approximately 68.44% between 1984 and 2010, 63.55% between 2010 and 2020, and 15.38% between 2020 and 2023.

Source: IRENA – Renewable Power Generation Costs in 2023 Report – Source: IRENA

These price reductions for solar photovoltaic and onshore wind energy can be attributed to several factors, including continuous technological advancements, economies of scale, increasingly competitive supply chains, and improvements in construction techniques for these projects.

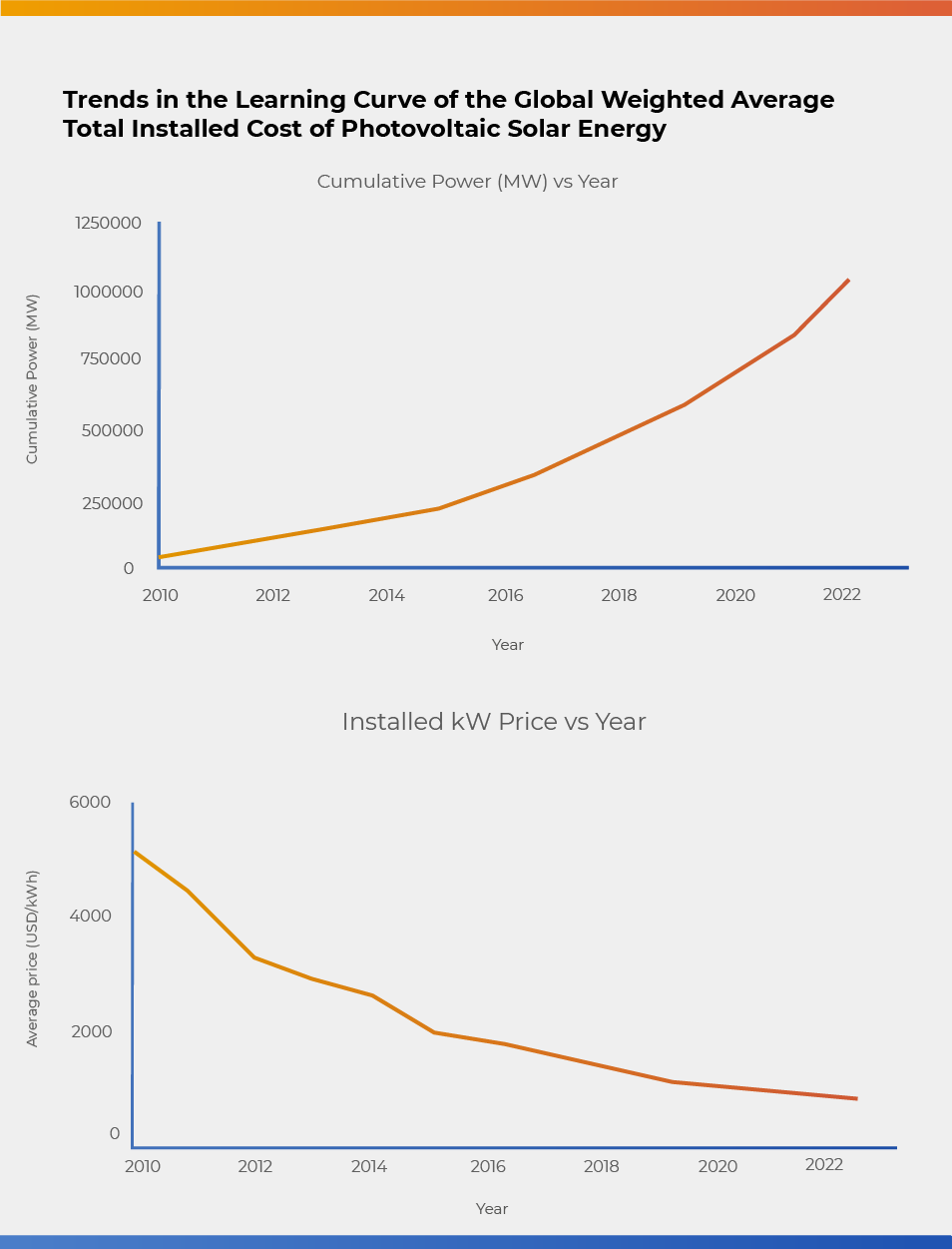

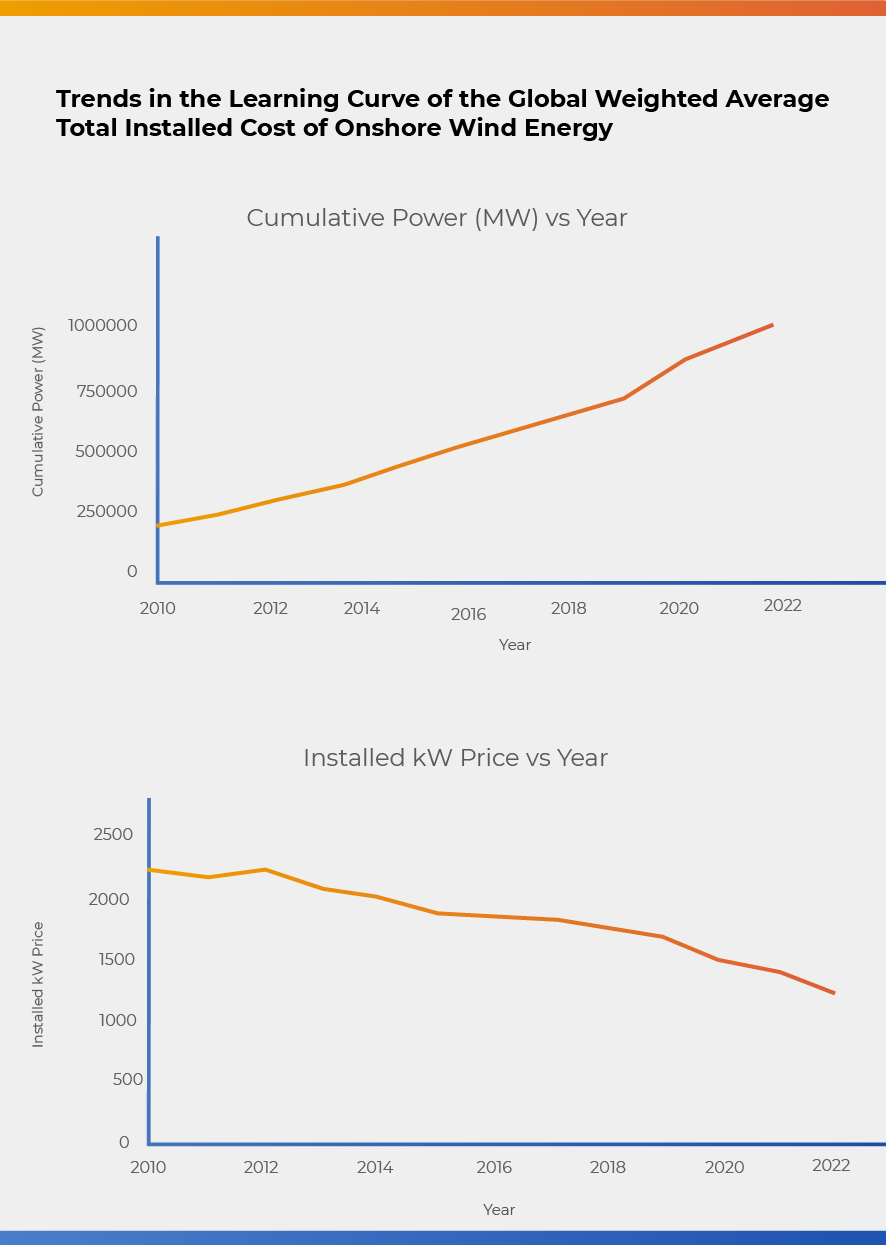

For this reason, the decrease in the cost of producing electricity with renewables has also been accompanied by a significant drop in the installation costs of these technologies.

In 2010, when approximately 40,277 MW of solar capacity was installed globally, the cost of installing one MW of a solar photovoltaic project was USD 5,124,000. By 2023, after a significant technological learning curve, the price had fallen to USD 758,000 per MW—nearly six times less. That same year, global installed capacity reached 1,412,093 GW.

Source: IRENA – Renewable Power Generation Costs in 2023 Report – Source: IRENA

A similar trend has been observed with wind energy. In 2010, the cost of installing one MW was USD 2,186,000, with a global installed capacity of 177,794 MW. By 2023, the price had dropped to USD 1,160,000 per installed MW, with a global connected capacity of 835,624 MW. In other words, cumulative capacity has increased year after year while prices have continued to decline.

Source: IRENA – Renewable Power Generation Costs in 2023 Report – Source: IRENA

Strategic Advantages Over Traditional Hydrocarbon Markets

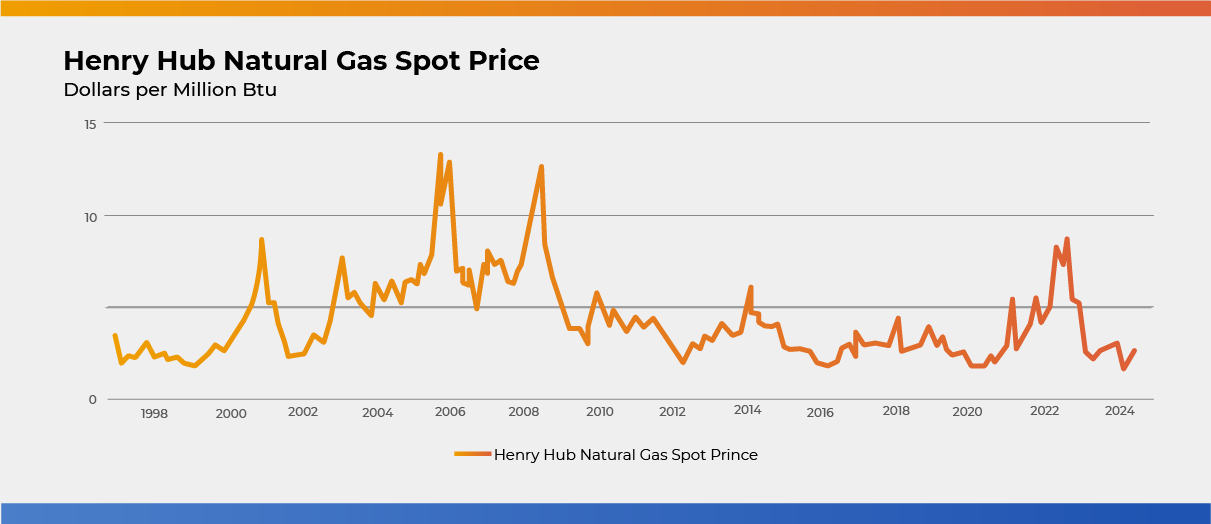

The proliferation of renewable energy across global power infrastructure extends beyond environmental considerations and cost optimization, fundamentally driven by the inherent volatility in hydrocarbon market dynamics.

Analysis of the Henry Hub index—the preeminent U.S. natural gas benchmark—reveals that the 2010-2020 decade exhibited stable pricing patterns, with sporadic peaks reaching USD 6 per million BTU in 2014, followed by sustained trading below USD 5 per million BTU and periodic troughs below USD 2 per million BTU in 2015, 2016, and 2020. This decade of relative stability starkly contrasts with the pronounced volatility characteristic of early 21st-century markets, where natural gas commanded premium pricing exceeding USD 12 per million BTU in both 2005 and 2008.

The post-2021 market environment has witnessed a resurgence of price volatility, with natural gas consistently breaching USD 5 per million BTU and reaching an apex of USD 8.81 per million BTU in 2022, primarily driven by geopolitical tensions in Eastern Europe.

Source: Chart sourced from “U.S. Energy Information Administration”https://www.eia.gov/dnav/ng/hist/rngwhhdM.htm

Considering natural gas prices, IRENA states that approximately 86% (187 GW) of the new renewable capacity installed in 2022 recorded lower electricity production costs than fossil fuel-based generation.

PPA, a Reliable Option

These price fluctuations drive companies toward securing long-term electricity procurement through renewable Power Purchase Agreements (PPAs). This transition has gained particular momentum as wind and solar photovoltaic technologies demonstrate mature cost structures with predictable pricing trajectories.

Analysis from consultancy firm Pexapark reveals compelling market validation: European PPA contracts reached 16.2 GW in 2023, representing a 40% year-over-year expansion from 2022 levels. This metric is a key indicator of an accelerating global trend across major economies as corporations increasingly leverage PPAs for strategic energy risk management.

Among the major renewable energy buyers were technology companies and firms from other sectors, such as oil companies and telecommunications service providers.

Source: Pexapark

In terms of pricing, another report from Pexapark indicates that 2024 began with a downward trend, as by the end of January, the average PPA price stood at €43.8 per MWh, a 12.8% decrease.

It is important to note that PPA prices vary depending on factors such as the country, technology (solar, wind), term length (longer terms typically result in lower costs), and other contractual aspects. In all cases, these long-term contracts offer benefits that positively impact corporate financial statements.

Signing a PPA does not require investments from the companies consuming the energy, nor does it pose a risk of system failure due to unforeseen operational issues, as the energy supply is guaranteed by contract.

Additionally, PPAs reduce costs compared to the volatile prices of the public electricity grid over extended periods, providing greater stability.

In every PPA, the agreement between consumers and the energy generator is not solely based on a fixed price for a certain volume of energy over a set term. Contractual conditions also play a crucial role in each agreement.

Depending on the country, Atlas Renewable Energy offers various ways to structure a PPA, including options such as allowing the customer to acquire the renewable asset after a specified period.

Another unique aspect of the company is the precedent it set in Chile by signing PPAs in March 2024 for a battery storage project. Through this initiative, Atlas will deliver clean energy consistently, 24/7, to two major Chilean companies: the state-owned mining company Codelco and the fuel distribution company Copec. The standout feature of these two agreements is its ability to guarantee uninterrupted energy delivery.

Growing Demand and the Role of Renewable EnergyA report published by the International Energy Agency (IEA) on July 2024 forecasts that global electricity demand will grow by 4% this year—the highest rate since 2007, excluding sharp rebounds in 2010 following the global financial crisis and 2021 after the COVID-induced demand collapse. Furthermore, demand is expected to increase by another 4% in 2025.

This growth is attributed to robust economic expansion, intense heat waves, and ongoing global electrification efforts.

Projections indicate that electricity consumption growth will substantially exceed global GDP expansion (forecast at 3.2%) in both 2024 and 2025.

IEA analysis attributes this accelerated demand to intensifying electrification across residential and transportation sectors, coupled with unprecedented expansion in data center infrastructure. Datacenter consumption reached approximately 460 terawatt-hours (TWh) in 2022, with projections exceeding 1,000 TWh by 2026, driven by artificial intelligence (AI) implementation and cryptocurrency operations.

Data center operations require an uninterrupted power supply, aligning with Atlas Renewable Energy’s innovative agreements with Codelco and Copec. Both PPAs integrated wind/solar with battery storage, ensuring continuous clean energy delivery.

Desalination infrastructure represents another emerging demand driver. World Economic Forum analysis projects global freshwater demand will exceed supply by 40% by 2030, necessitating extensive desalination deployment for diverse applications spanning human consumption, mining operations, agricultural activities, industrial processes, and data center cooling systems operating above 25°C.

While desalination technology has achieved significant efficiency optimization, its expanding implementation necessitates substantial energy requirements. Contemporary seawater reverse osmosis facilities operate at 3 kWh/m³, representing a 94% efficiency improvement from legacy evaporation systems requiring 50+ kWh/m³.

Strategic Market Expansion in Renewable Energy

Current demand trajectories indicate robust growth potential in renewable energy markets. Beyond environmental benefits through zero CO2 emissions, wind and solar photovoltaic technologies have emerged as globally competitive energy sources, offering superior price stability compared to hydrocarbon alternatives.

IEA projections indicate renewable sources—including solar, wind, and nuclear—will satisfy over 90% of incremental global electricity demand through 2025.

Supporting this trajectory, IEA analysis forecasts solar photovoltaic and wind power installations will double by 2028 relative to 2022 levels, establishing consecutive records and achieving approximately 710 GW of new capacity.

Latin American and Caribbean Market Evolution

The Latin American and Caribbean regions have demonstrated significant renewable energy adoption.

IRENA’s 2023 analysis documents sustained renewable capacity expansion across the region over the past decade. Total installed renewable capacity reached 319 GW in 2022, advancing from 295 GW in 2021 and 255 GW in 2020.

This capacity encompasses 42.8 GW of wind energy and 45.6 GW of solar photovoltaic infrastructure.

Conclusion

Wind and solar photovoltaic technologies continue demonstrating superior reliability and competitive advantages, including zero emissions and enhanced price stability.

Consequently, renewable PPAs become an increasingly compelling strategic option for global corporations. This trend is evidenced by accelerating corporate adoption of long-term agreements securing pricing structures insulated from geopolitical and climatic volatility.

This article was created in partnership with Castleberry Media. At Castleberry Media, we are dedicated to environmental sustainability. By purchasing carbon certificates for tree planting, we actively combat deforestation and offset our CO₂ emissions threefold.

Share This Entry