7 factors influencing the renewables market in Latin America

In recent years, the Latin American renewables market has undergone a dramatic transformation, with political risk factors, investment trends, technological advances, and external shocks affecting the sector in myriad ways. As the Covid-19 pandemic brings historic disruption to the world’s economies, we lay out the trends shaping the Latin American market and our outlook for the sector going forward.

Power sector demonstrates resilience amid infrastructure slowdown

As the world continues to count the economic and human cost of Covid-19, its impact on infrastructure projects has begun to emerge. The outbreak has caused factory closures, halts in production, and delayed shipments. The United Nations Conference on Trade and Development (UNCTAD) estimates a potential US$50bn decrease in exports across global value chains in the first quarter of this year alone as a direct result[1].

On the demand side, as government funding and bureaucratic capacity are diverted towards combating the outbreak of the virus, ongoing infrastructure projects have been halted and project pipelines canceled. With movement restrictions and shelter-in-place regulations still in force in several geographies, public procurement has ceased while operational restrictions and economic certainty are holding back private sector investment in many infrastructure projects.

Not so for the power sector. With much economic activity heavily dependent on the use of electricity, maintaining, and even expanding energy access has become a priority. Because of this focus on electricity generation capability, governments around the region have ruled power projects as essential infrastructure development, even during lockdowns.

Renewables demand holds up even as electricity usage plunges

That isn’t to say that all is well for the power sector. The Covid-19 pandemic has caused the biggest shock to the global energy system in more than seven decades, with a 6% drop in demand for 2020[2] – the equivalent of losing the entire energy demand of India, the world’s third-largest energy consumer.

Taking the brunt of this significant decline is coal, which has fallen so far this year, that we believe the industry might never recover.

Statistics coming in from around the world support our view: the UK has marked a whole month without burning a single lump of coal for electricity generation –the longest uninterrupted period since 1882. Sweden has closed its last coal-fired plant two months ahead of schedule. And for the first time in history, the US will produce more energy from renewables than from coal this year. We don’t think coal is coming back any time soon, particularly as growing concerns over carbon emissions and climate change put project approvals in doubt.

Overall, the plunge in demand for nearly all major fuels is enormous, especially for coal, oil, and gas. But renewables are holding up, according to a new report by the International Energy Agency. It projects that solar PV and wind are on track to lift renewable energy generation by an impressive 5% in 2020, as governments take this opportunity of lower demand to reduce fossil fuel dependency and move to clean energy.

Additionally, as the economic impact of Covid-19 hits companies’ bottom line, they are starting to seek out cheaper energy sources to hold down costs, further boosting demand for wind and solar power. This momentous shock means that the energy industry that emerges from this crisis will be quite different from the one that came before, and we believe that renewables will shape the future of the energy world.

Technological advances keep driving costs down

One of the most obvious reasons renewables are set to do well, particularly in Latin America, is their low costs. This downward pricing trend is going to consolidate itself further as technological advances make solar and wind power cheaper – and better – as the years go by.

But don’t take our word for it. The latest report by the International Renewable Energy Agency (IRENA) shows that unsubsidized renewable energy is now the most affordable power source for many locations and markets, with cost reductions set to continue into the next decade.

Meanwhile, improvements in battery storage systems, which can effectively integrate high shares of solar and wind renewables into power systems, as well as an increase in availability of smart grid and metering systems around the region, will see low-cost renewable electricity generation continue to underpin Latin America’s energy sector transformation to 2050.

A new perspective from financiers

As governments look to boost their economies post-pandemic, capital demands for secure, profitable, and predictable returns will increase. Operational and greenfield renewables projects from companies like us, who have a strong track record in the industry, make even more sense at times like these.

In fact, because wind and photovoltaic power are no longer seen as nascent technologies, we’ve seen investors becoming more comfortable with investments in these sectors. The latest data from BNEF proves this: investment in renewable energy capacity worldwide climbed to US$282.2bn last year, up 1% from 2018’s US$280.2bn, even in the face of a subdued global investment landscape.

In Latin America, that growth was substantially higher. In 2019, Brazil lifted renewable energy capacity investment by 74% to US$6.5bn, while Mexico committed US$4.3bn, up 17%, and Chile US$4.9bn, up fourfold. Only Argentina bucked the trend, with an 18% fall.

We’re seeing investment coming into the sector from all sides. In the past five years, major project finance banks have increasingly offered long-term traditional non-recourse financing, but so, too, have the capital markets. This array of optionality allows developers to obtain more efficient financing in both cost and tenor terms, which then further drives down the cost of electricity, enabling contracts to be won at a lower price.

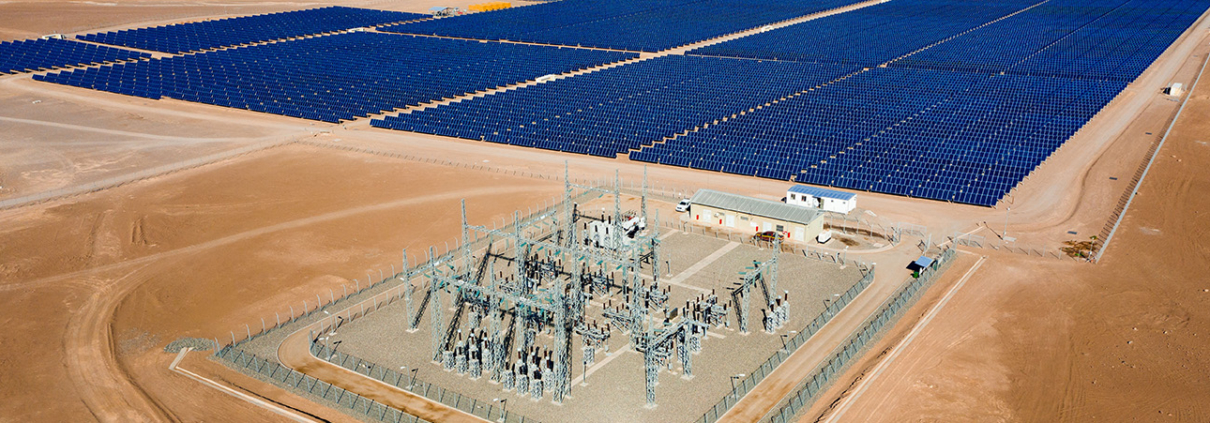

The growing trend toward sustainable finance is paying dividends in the Latin American renewables market, with investment-grade green bonds powering the construction of numerous projects around the region. Our recent issuance of a US$253mn private placement (USPP) with DNB Markets to refinance Javiera and build Sol del Desierto, two solar PV plants located in the north of Chile, is one example, marking the largest solar PV green USPP issuance in Latin America to date. Meanwhile, innovative structures, such as the US$114.4mn bond we issued for our El Naranjal and Del Litoral solar power plants in Uruguay, demonstrate the ability of local players to put together solid capital structuring. The financing was placed by DNB Markets and the Inter-American Investment Corporation (IDB-Invest) and arranged as an A/B bond structure with an investment-grade senior tranche and a sub-investment grade subordinated tranche, both at attractive rates and long tenors.

The rise of corporate PPAs

However, structuring the right kind of financing is only half of the battle. For investors, the key factor influencing decisions is the ability of an energy producer to sign supply contracts with offtakers with healthy financial track records.

Due in large part to pressure on corporations for sustainable and economical energy solutions, corporate power purchase agreements (PPAs), whereby businesses purchase electricity directly from independent generators instead of from a utility, have surged in Latin America.

2019 marked a record year for corporate PPAs in the region, as companies purchased 2GW of clean energy – a threefold increase over 2018. This figure is set to increase further as a growing number of firms aim to reduce emissions in line with the Paris Agreement, and sign-up to initiatives such as the RE100 target whereby they pledge to offset 100% of their electricity demand with clean energy.

But it is not just sustainability factors that are driving this trend. Market liberalization is also playing its part. Argentina, Brazil, Chile, Colombia, Mexico, and Peru have issued regulations that facilitate access to bilateral PPAs and spot markets, and we’ve seen corporations also look to these agreements for economic advantages, including long-term price predictability and the ability to hedge against future price increases.

As Latin America’s renewable energy and power storage market grows, yet more innovative structures are available to spread corporate PPAs to a larger number of players, with fewer take-or-pay contracts and a shift towards delivery-focused deals which aim to serve the load of the offtaker.

Investment and energy policies support the transition to renewables and boost economy

During last year’s UN Climate Conference COP25 in Madrid, a new regional initiative coordinated by the Latin American Energy Organization (OLADE) laid out plans to reach at least 70% of renewable energy in electricity by 2030. The commitment by Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Haiti, Honduras, Paraguay, and Peru is open for the participation of other countries in the region, and seeks to build upon the world-beating progress made by a series of reforms put in place by governments across the region which aim to lure investment into the Latin American renewable energy industry.

We believe Latin America will continue to lead the world in its dedication to the growth of the share of renewables in the region’s energy matrix, even in the face of an uncertain political context in some countries. We’ve seen for ourselves that although new administrations often bring with them new investment and energy policies, affecting appetite for different markets, the overarching commitment to clean energy across Latin America has remained pretty constant.

The continued profitability of renewable energy now stands in sharp contrast to other assets across the region, with many backers coming to view the sector as a relatively safer bet in these troubled times. In fact, beyond just being a safer bet, we believe renewables will help power Latin America’s recovery after Covid-19.

Land of opportunities – with the right partner

The renewable energy market in Latin America is at an inflection point, poised to expand substantially and help boost the economic recovery post-Covid. With favorable energy and investment policies and growing demand for clean power, the region provides unprecedented prospects for investors who are able to navigate the market. But not all opportunities are created equal. In order to take advantage of Latin America’s green energy revolution, investors must ensure they have the support of trusted partners who can structure profitable, secure transactions focused on strong risk management and bankable long-term and stable contracts with credit-worthy sponsors.

Atlas is a leading renewable energy generation company operating across all of Latin America. With one of the largest solar asset bases in the region, Atlas specializes in developing, building and operating large-scale renewable energy projects that are tailor-made for Latin America’s energy needs. For more information please contact us at: contacto@atlasren.com

SOURCES COMPILATION

- https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=2297

- https://www.pv-tech.org/news/bloombergnef-cuts-global-solar-demand-forecast-on-coronavirus-concerns

- https://www.woodmac.com/our-expertise/focus/Power–Renewables/wind-mou-q1-2020-coronavirus/?utm_source=gtm&utm_medium=article&utm_campaign=wmpr_mouq12020

- GlobalData: Chile’s non-hydro renewable energy reached 4.5GW by 2018

- https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/May/IRENA_Renewable-Power-Generations-Costs-in-2018.pdf

- https://data.bloomberglp.com/professional/sites/24/BloombergNEF-Clean-Energy-Investment-Trends-2019.pdf

- https://www.citigroup.com/tts/solutions/trade-finance/assets/docs/The-rise-of-renewables-in-Latin-America.pdf

[1] https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=2297

[2] https://www.weforum.org/agenda/2020/05/covid19-energy-use-drop-crisis/

Share This Entry